Archive

Guest blog on GDPR

From my friend Tony Groom of K2 partners who are leaders in the turnaround sector

https://www.k2-partners.com/smes-approach-marketing-post-gdpr/

KPMG. Let off too lightly

According to the FRC, which is itself under heavy pressure to demonstrate a tougher approach to monitoring the audit market, half of KPMG’s audits of FTSE 350 clients required “more than limited improvements”.

Half?

This is outrageous. How many other professions would get away with such shoddy performance? The big four auditing firms are a huge problem and it is past the point of slaps on the wrist and “warnings”. A new book covers this very subject and I anticipate posting a review sometime soon but the key is what action should be taken?

In view of the above regulators comment then surely the firm should be stripped of its audit licence for a set period of time (five years?) and the responsible partners banned for the same period of time.

Their seedy craven behaviour has led to any number of suppliers and customers being hammered by the collapse of firms (Carillon) who were trading illegaly

Auditing has to be opened up to firms outside of the cartel

This is a subject I will be returning to

Clydesdale to Virgin. Why???

When many of us think of Richard Branson’s businesses we think of Virgin Media with its dated websites and quite shocking customer service. We also think of the train company which is the only one I know to pettily charge for wifi usage (might surprise many to know that the best wifi is on Southern). We do not buy into its self image of being ever so cool and customer friendly. Tacky is a word that springs to mind.

Virgin, Clydesdale and Yorkshire Bank are about to merge under a banner of CYBG. It is said that the whole group will rebrand under the Virgin label in a bid to win new customers. I wonder…

Clydesdale are a bank with whom i have had some excellent dealings and their staff are generally very high quality. As a banking brand, I would suggest they are as strong as you will find in the UK and are most certainly well respected (from experience I cannot comment on Yorkshire bank, but I have not been aware of negatives). They are strong in the SME business banking market and this is crucial to the future because I simply find it difficult to see my clients instinctively taking “Virgin Money” particularly seriously, especially given that another rather noisy consumer driven challenger bank has gained quite a poor reputation in the business sector.

Clydesdale and Yorkshire have been shunted around for years and probably underachieved as a result but the brand name is still good and there is genuine goodwill towards banks just outside of the major players. Whether that goodwill extends to Richard Bransons branding is a different matter

I would suggest that they think this through carefully

Are the big lenders losing interest in invoice financing?

With one notable exception, the major banks appear to be pulling away from invoice finance. Naturally they will never publicly admit a lack of interest or appetite to lend so its down to the broker to ascertain the market through their actions as well as information on their behaviour within current clients. I have become aware of a number of very interesting recent case studies

With a couple of the major lenders the attitude towards SMEs and invoice financing has changed markedly in recent months. Prices have been raised and more significantly, little effort is being made to keep clients seeking to move. With that mindset you can be assured that service will not be a priority but perhaps even more importantly, borrowers will not be obtain the leeway and flexibility that is often required in invoice financing.

When you or your client wins significant new business, the support of the lender can be crucial. Also there may be times which are a little difficult due to seasonality or simply cashflow.

The other side of the coin is that the independent lenders are as hungry as ever and they know that they have to deliver.

Remember that there are over 50 lenders in the market. Many brokers will not explore all the options but you or your client can be assured that that is my guarantee.

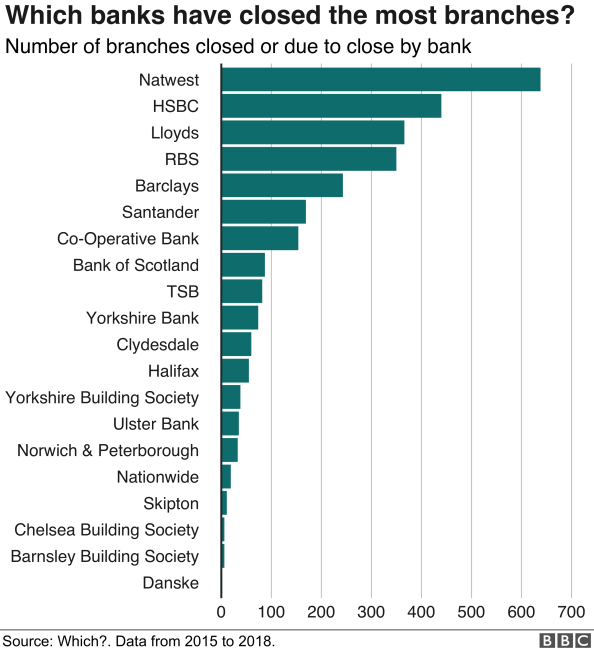

60 Bank branches closing a month

The figure suprised me too. Not surprising that branches are closing and frankly many have little real purpose now but the rate is extraordinarily high. It is also interesting to note the variations between one bank and another. Barclays are certainly intent on a slower rate of closures

Italy stops trade deal

With all this weeks fuss aboit brexit one story has seemingly slipped under the radar which would a significant continuing argument for Brexit. The EU have made a great fuss out of their trade deal with Canada (without ever asking why its taken 60 years to get there) and now it could be scuppered by Italy’s new government who significantly claim there are doubts right across the 28 member nations. The dispute is over Italian Cheese

This is of course the perennial problem and why the EU has been so poor at concluding trade deals.

Barclays. Sign of things to come?

Barclays have strongly signalled more restrictive lending in the months to come.

Chief executive Jes Staley says Brexit uncertainty was helping to stunt economic growth and that was something the bank could not ignore.

Whichever way anyone voted on Brexit, this was a near inevitability. Clearly the doom laden forecasts of George Osbourne and Mark Carney did not come to pass and frnakly looked pretty ridiculous but its impossible to dismiss the fact that “uncertainty” is damaging.

“In no way do we pull back in a radical fashion – but we will look at our credit exposures and see whether that’s proper given the direction of the economy,” Mr Staley said.

“We can at the margin tighten some of our underwriting criteria and credit standards just to be prudent for the stability of the bank.”

Ignoring the rather mangled poor english, I think this is a clear meassage. I sense that many SMEs will feel the pinch and those banking with Barclays should perhaps consider options. Having said that they are the least proactive big four bank in invoice financing which gives an indication that their strengths lie elsewhere.

The question that does arise is whether other banks will follow suit. I sense that they will

Landlords bite back

Apparently a number of commercial landlords are going to consider voting against CVAs proposed by the likes of House of Fraser. They clearly believe they are in a position of strength because they no doubt have a queue of interested tenants for vacant department stores.

That of course is not the case and as I blogged before, the landlords may just have to accept that they have a lot of supply but not much demand

Tough